As an employer and sponsor of a retirement plan, your company shoulders a great many responsibilities. Among them: listening to the needs of your employees, selecting appropriate retirement plan service provider(s), choosing and monitoring investments, keeping up with legislative changes, ensuring your plan is administered properly, and educating and informing plan participants – all at a reasonable cost.

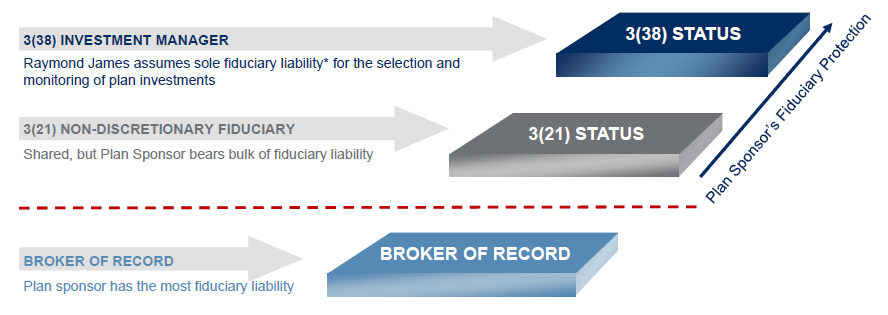

Fiduciaries under ERISA are held to a high standard and breach of fiduciary duty could result in personal liability. One way to reduce the scope of fiduciary liability is to hire prudent professionals, including for example, non-discretionary investment advisors or discretionary investment managers.

Some plan sponsors are looking for assistance with their fiduciary responsibilities, but want to maintain discretion and control of the investment lineup. In this instance a 3(21) fiduciary could help with regards to the recommendation and, monitoring of plan investments. Others want to shift responsibilities to a third party due to their lack of expertise and time or, fear of exposure to liability. A 3(38) fiduciary, by taking full discretion for investment selection, monitoring and replacement, helps to ensure that investment selection fiduciary responsibilities* are being met, all while saving you time so you can use it more effectively.

It is important to understand the difference between hiring an advisor who is willing to act in a fiduciary capacity vs hiring an advisor that simply takes on a “broker of record” role.

All investments are subject to risk, including loss. Asset allocation and diversification does not ensure a profit or protect against a loss. There is not assurance that any investment strategy will be successful. Advisory fees are in addition to the internal expenses charged by mutual funds and other investment company securities. To the extent that clients intend to hold these securities, the internal expenses should be included when evaluating the costs of a fee-based account. Clients should periodically re-evaluate whether the use of an asset-based fee continues to be appropriate in servicing their needs. A list of additional considerations, as well as the fee schedule, is available in the firm’s Form ADV (Part 2A) as well as the client agreement.